Create a High-Quality Partner Network

Gain Better Profit Margins

Keep Competitive Advantage

Powering up Industries

with KYC data & Introductions

Trade Finance

Get the right insights to make informed decisions about who to fund. Identify trustworthy borrowers and reliable trading relationships.

Shipping companies

Verify your customers reputations instantly, and save time and resources. check their trading relationship for smoother shipments fewer delays and more opportunities.

Scrap Metal Exporters

Grow your Scrap Metal Exporter base in new and existing markets. Save time and recourses with PartnerLink to meet new pre-vetted Scrap Metal Exporters in 3 days.

Scrap Metal Importers

The fastest way to meet pre-vetted, factory-direct buyers you didn’t even know existed. Get introduced in 72 hours.

See some of the latest submitted trade reviews

Want to learn more?

Chris Yerbey

26 years in recycling, ex- scrap trader, and now your dedicated Consultant.

Nick Clark

Your CSM and vetting partner for developing trust-based relationships in the scrap metal recycling Industry.

Discover our tailored services that help you grow

KYC Reports

Find new and reliable Scrap Metal Importers or Exporters

Ensure success and secure your investments with thorough background checks and verification of potential Scrap Metal Partners.

PartnerLink

Connect with pre-vetted Scrap Metal Importers or Exporters

Use our strategic growth program backed by our rigorous vetting and industry expertise and expect your first introductions within 72 hours

Get the latest from Tradefox

Import Tariffs on Scrap Metal in the U.S.

An in-depth look at U.S. import tariffs on scrap metal, their impact on pricing and the recycling industry, and how Tradefox helps businesses navigate trade regulations.

Webinar recording: Critical Angles of Due Diligence

On October 3rd 2024 Tradefox organized a free webinar: Angles of Due Diligence

Webinar: Growing Your Buyer Base with PartnerLink

On November 14th 2024 Tradefox hosted it’s second webinar: Growing Your Buyer Base.

Tradefox helped us recover $40,000

Tom Liao tells about his Capital Recovery experience with Tradefox

Learn more about

the Tradefox story

These industry leaders trust Tradefox

for their due diligence and introductions

Frequently Asked Questions

What exactly is Tradefox and how can it help my business?

Tradefox is a business intelligence platform that helps recycling companies make safer trading decisions by providing:

- Building new trading partnerships based on data with PartnerLink Service

- Detailed reputation reports on potential trading partners with KYC Intelligence Reports

- Reliability scores based on actual trading history

- Quality and payment track records

- Early warning signals about problematic companies

What kind of businesses use Tradefox?

Our platform serves:

- Scrap yards and recycling processors

- International traders and brokers

- Steel mills and foundries

- Trade financing companies

- Demolition companies

- Any business buying or selling recyclable materials internationally

How much does it cost and what do I get?

We offer four subscription levels:

Starter Plan: €0/month – Claim & improve your profile and review trading partners – Individual reports can be purchased for €30 each

- Basic Plan: €99/month – Access to basic features and up to 10 company reports

- Plus Plan: €199/month – Up to 30 reports and enhanced collaboration tools

- Pro Plan: €299/month – Up to 50 reports plus monitoring and additional services

How do I get started?

Getting started is simple:

- Sign up on Tradefox.co

- Get up to 5 free credits by optimizing your company profile

- Review your trading partners against competitive discounts

- Access company reports immediately

- Monitor existing partners

- Our dedicated support team helps with onboarding

How do you verify the information in your reports?

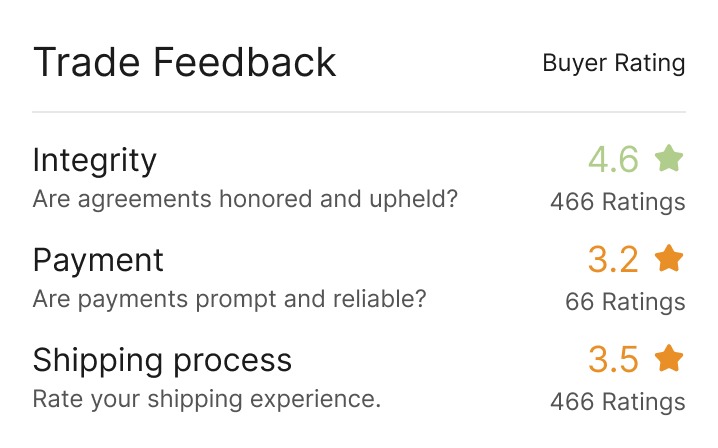

Our data comes from multiple verified sources including:

- Import/export records from customs agencies

- Verified peer reviews from trading partners

- Financial data from credit reporting agencies

- Shipping records and trade documentation All data is processed through our verification algorithms before being included in reports.

How quickly can I access information about a company?

Instantly. Company reports are available immediately upon purchase, or test account activation. Contact us by sending an e mail to: support@tradefox.co

What if a company isn't in your database?

We can:

- Create a new profile within 24-48 hours

- Collect available trade data

- Initiate monitoring

- Add the company to our verification process

How can Tradefox help prevent losses?

By providing:

- Advance warning of risky partners

- Providing peer-to-peer reviews of actual partner trades

- Quality track records

- Payment history

- Contract compliance data

- Dispute resolution patterns

What makes Tradefox different from credit reports?

Tradefox provides:

- Actual trading behavior history

- Quality performance records

- Payment reliability patterns

- Industry-specific insights

- Real-time monitoring Traditional credit reports only show financial status.

Scrap metal companies

Scrap metal companies are the linchpin of modern scrap metal recycling, taking obsolete metal from factories, demolition sites and households, then matching each load with the right downstream buyer. They begin by inspecting and grading incoming scrap, because the value of a mixed pile rises quickly when alloys are sorted correctly. Prices, environmental targets and supply-chain resilience all improve when scrap metal companies keep that flow moving efficiently.

How scrap metal companies create value

Scrap metal companies negotiate purchases from local generators and, when acting as importers, line up overseas supply for mills that need volumes or chemistries not available at home. These operations weigh and grade material, cut oversized pieces so they fit containers and arrange door-to-port or port-to-mill logistics. The teams issue scale tickets, secure foreign currency, handle letters of credit and file both export and import paperwork so customs officers wave loads through. Every shipment that clears on time saves manufacturers storage space and CO₂, so the yard’s role is commercial and environmental at the same time.

When import-oriented trading desks see a gap in domestic scrap flows, they scan multiple continents at once, compare grades, freight rates and transit times, then balance currency risk so price spreads stay profitable. Their buyers book inspection agents, monitor radiation certificates and arrange pre-clearance with destination customs, because one mis-graded cargo can erase margin with reprocessing costs. By taking on that complexity, these specialized scrap metal companies keep furnaces charged, protect cash flow for processors and give metal recycling companies the certainty they need to plan production.

Metal recycling companies and advanced processing

Metal recycling companies, sometimes the same organisations but equipped with heavier machinery, push the process further. They shred cars, bale wire, separate metals with eddy-current and optical systems and deliver chemistry-guaranteed bundles to mills. Because a furnace needs tight specifications, processors remove contaminants, extract fluids and test alloy composition, so their output meets melt-shop standards. The extra preparation earns a premium and reduces the energy required to make new steel or aluminium.

Collaboration between scrap metal companies and processors

Scrap metal companies keep collection networks dense, but processors create mill-ready feedstock, so both sides win when they cooperate. Traders supply constant tonnage; processors unlock value; manufacturers receive predictable, low-carbon raw material, and cities send less waste to landfill. Demand for scrap metal recycling grows whenever this partnership shortens the loop between discard and production.

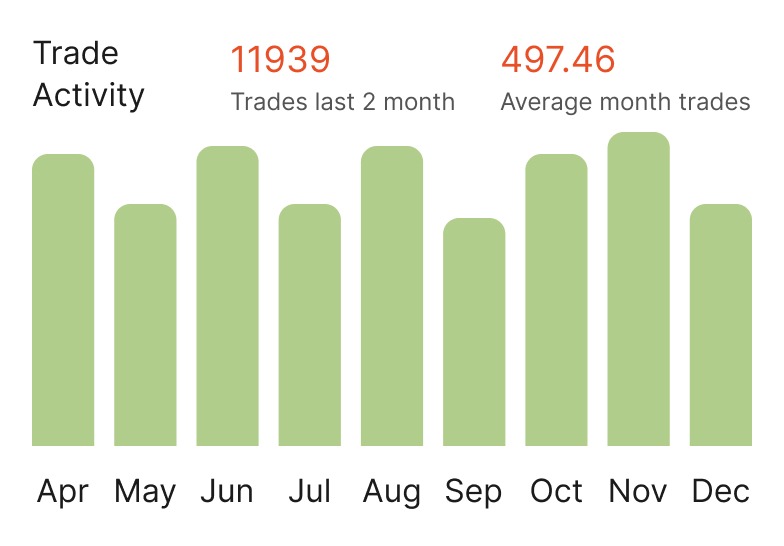

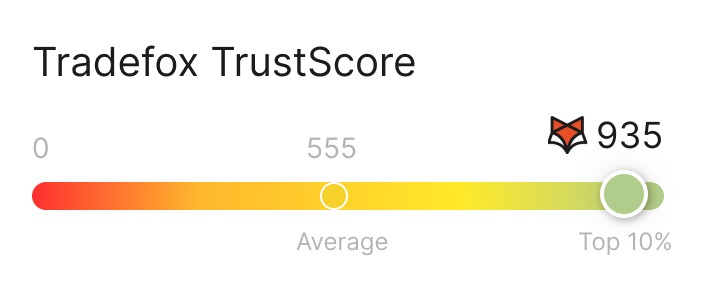

How Tradefox supports scrap metal companies

Tradefox equips scrap metal companies with data that protects margins and reputation. The platform tracks 159,796 company profiles, 250,983 trade reviews and 128,628 TrustScores across 189 countries, so a scrap yard can verify integrity, payment history and quality before cash changes hands. Its PartnerLink service finds pre‑vetted buyers, and as founder Chris Yerbey notes, “a warm intro from a shared partner or Tradefox’s PartnerLink service can change everything and line up pre‑vetted partners in 72 hours”.

Scrap metal companies also receive continuous monitoring alerts if a partner’s score drops, so they can act before trouble spreads. Yerbey reminds scrap recyclers that factory buyers “trust what others say about you,” so sharing a Tradefox reputation report helps close deals faster. Because risk shrinks and confidence rises, yards ship more scrap, processors run fuller shifts and the entire scrap metal recycling loop keeps turning.

Scrap metal companies thrive when information is clear, processing is efficient and partners are trustworthy. With real‑time data from Tradefox and collaboration with metal recycling companies, they can meet those goals and power a circular economy that benefits everyone.

Scrap metal importers

Global sourcing across borders

Import-focused businesses search beyond their own coast so they never run short of the grades that local yards cannot supply. They track spot prices, talk to exporters on several continents and secure freight before market spreads vanish. Because they combine volume from many sellers, mills and metal recycling companies receive steady feedstock even when regional flows slow. Importers keep paperwork moving as well, and they line up inspection agents, fumigation slots and port handling so containers clear quickly.

Managing risk and compliance

Buying scrap across borders is profitable, but every shipment must pass customs, radioactivity scans and alloy checks. Import-focused scrap metal companies therefore run Know-Your-Customer screens, sanctions checks and credit reviews before issuing a purchase order. They also hedge currency exposure, and they inspect cargo photos because one mis-graded container can erase margin once reprocessing costs hit. Careful compliance keeps trade lanes open and protects the supply chains of downstream metal recycling companies.

How Tradefox streamlines buying for scrap metal importers

Tradefox condenses risk data into a live dashboard that covers more than 159 000 trading entities and 128 000 TrustScores, so importers can weigh integrity, quality and payment history before cash changes hands . Founder Chris Yerbey explains that “a warm intro from a shared partner or Tradefox’s PartnerLink service can line up pre-vetted partners in 72 hours,” and importers use that speed to lock in deals while spreads are still attractive . Continuous monitoring then watches for score changes, so buyers can reroute orders before trouble spreads.

Value for metal recycling companies and the circular economy

When importers manage risk well, steel mills and smelters can melt higher scrap ratios, so they cut ore use and emissions. Reliable cross-border flows also backfill regional shortages, and that lets metal recycling companies plan furnace schedules with confidence. Society benefits too, because every tonne of imported scrap keeps valuable material out of landfill and pushes the loop of scrap metal recycling closer to full circularity.

Scrap metal exporters

Building global demand from local scrap streams

Scrap metal exporters turn domestic surplus into global opportunity, and they help scrap metal companies capture value that home markets cannot absorb. They gather offcuts, vehicles and demolition scrap, then grade, cut and bundle each load so it meets international specifications. Because they already know which mills in Asia, Europe or the Middle East need which alloys, exporters can match tonnage with demand quickly, and that keeps prices firm for local collectors. Global buyers trust exporters that communicate clearly, and founder Chris Yerbey reminds sellers that “borrowed trust” from reliable partners accelerates every deal .

Compliance, shipping and quality assurance

Export-focused scrap metal companies juggle vessel bookings, container inspections and ever-changing regulations, but they still need to deliver on time because mill furnaces run to tight schedules. They secure environmental permits, customs codes and radiation scans, and they document every bundle’s chemistry so cargo moves smoothly through destination ports. If paperwork or quality slips, shipments face costly rejections, so exporters invest in on-site spectrometers, loading photos and third-party surveys. These steps build confidence for overseas metal recycling companies and protect margins for everyone in the chain.

Tradefox tools that unlock new buyers

Tradefox shortens the distance between exporters and unfamiliar buyers. Its database tracks more than 159 000 companies and over 128 000 TrustScores, giving sellers proof of credibility before the first offer sheet travels. PartnerLink then introduces exporters to pre-vetted importers in as little as 72 hours, and Yerbey notes that a warm introduction “can line up pre-vetted partners in 72 hours” . Continuous monitoring alerts exporters if a buyer’s rating drops, so they can redirect cargo before risk turns into loss, and that makes negotiations faster and safer for both sides.

Circular gains for global metal recycling companies

When exporters move surplus scrap to regions with melt-shop shortages, steelmakers and smelters can use higher recycled content, and that cuts virgin ore demand and emissions. Reliable export flows also stabilise prices, so metal recycling companies plan furnace loads confidently and cities divert more waste from landfill. By connecting local scrap streams to distant mills through transparent, data-driven trade, scrap metal companies and their exporter branches keep the scrap metal recycling loop turning worldwide.

KYC Data Reports for scrap metal companies

Real-time trust scores

Tradefox KYC Data Reports combine peer feedback, customs filings, licence data and credit signals into a single TrustScore, so scrap metal companies and metal recycling companies can gauge reliability before they commit. Every profile highlights payment history, quality disputes, sanction status and insurance details, and it translates raw data into plain-language risk notes that buyers and sellers can act on quickly.

Continuous monitoring that protects margins

Scrap metal trading conditions change fast, so Tradefox watches each counterparty after the first check. When a partner’s TrustScore drops, procurement teams receive an alert and can renegotiate terms or switch suppliers before a late payment or mis-graded cargo hurts the bottom line. This early warning turns fragmented risk signals into clear action steps and keeps reputations intact while saving the hidden costs of reprocessing, demurrage and legal claims.

PartnerLink introductions for scrap metal companies

Pre-vetted partners in 72 hours

PartnerLink uses the same intelligence that powers KYC Data Reports to shortlist buyers and sellers who already meet quality and compliance standards. Founder Chris Yerbey notes that “a warm intro from a shared partner or Tradefox’s PartnerLink service can line up pre-vetted partners in 72 hours,” and that speed lets exporters move surplus tons while prices are high and importers fill urgent grade gaps without delay.

Negotiations that start with trust

Because legal, payment and quality checks are completed before the first call, both sides enter talks ready to discuss price, volume and logistics instead of basic credibility. Human brokers handle time zones and cultural nuances, and data backstops every match, so deals close faster and fraud risk stays low. The result is steady furnace feed for metal recycling companies, fewer idle containers for logistics teams and higher growth for the global network of scrap metal companies.

Start transforming your due diligence in scrap metal recycling today

To conclude, don’t navigate the complex world of recyclables trading without the industry’s most trusted verification solution. With Tradefox, you gain access to unparalleled data, powerful analytics, and a global network of verified trading partners.